pay indiana estimated taxes online

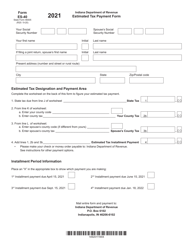

If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. Kansas City Internal Revenue Service 333 W Pershing Rd.

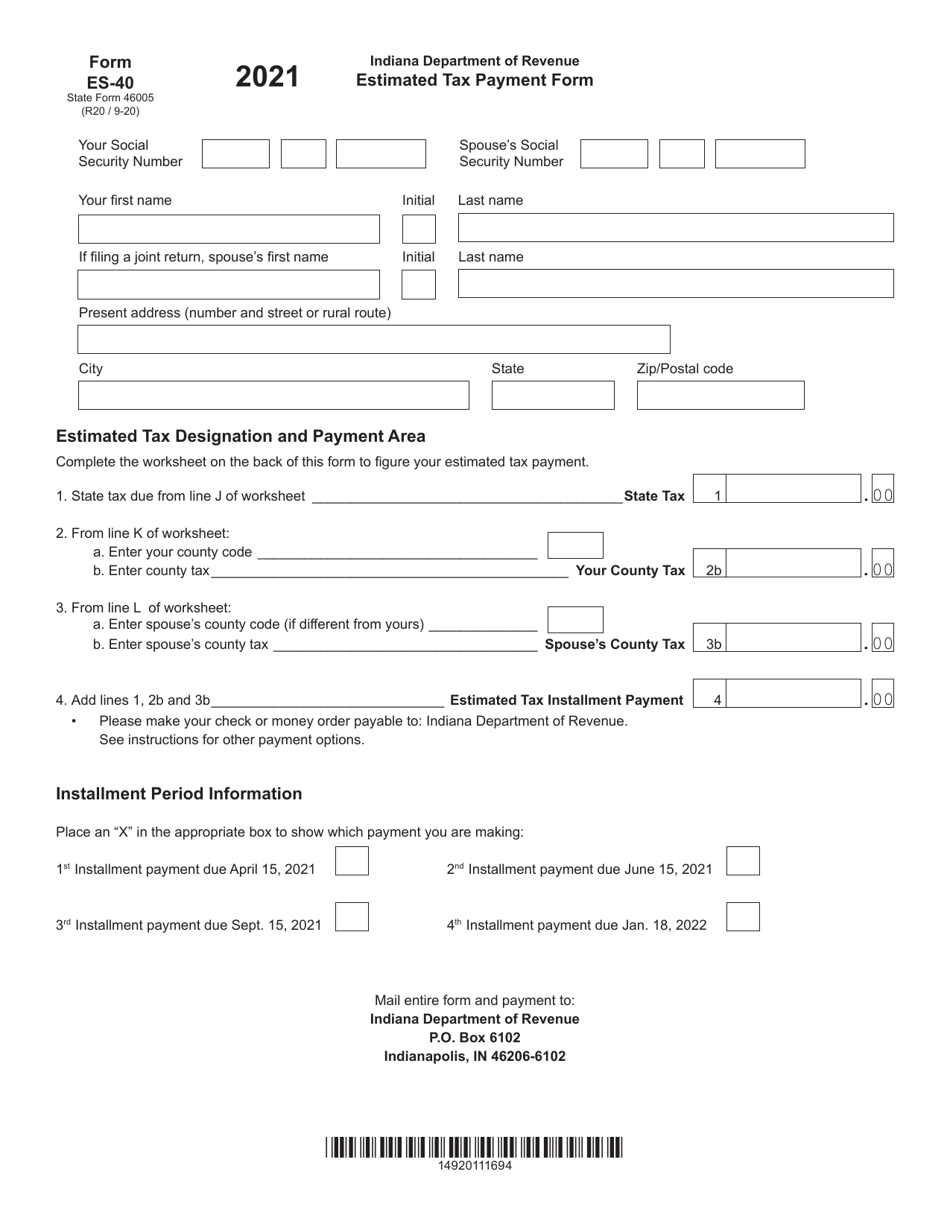

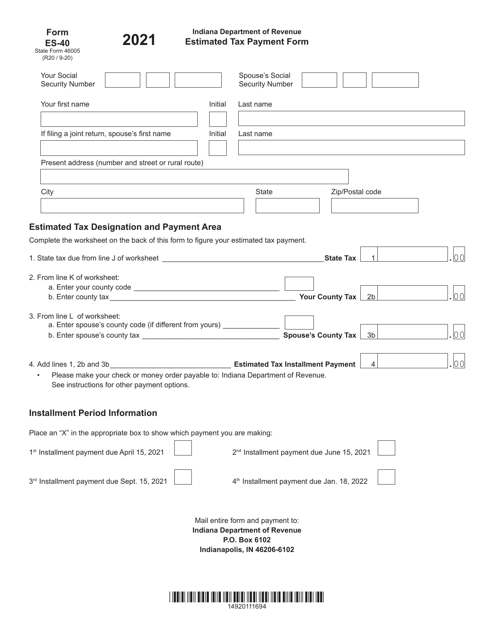

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Pay my tax bill in installments.

. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. ATTENTION-- ALL businesses in Indiana must file and pay their sales and withholding taxes electronically. The failure-to-pay penalty is less punitive than the one for failing to file.

Claim a gambling loss on my Indiana return. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Find Indiana tax forms.

DORpay is a product of the Indiana Department of Revenue. To make an individual estimated tax payment electronically without logging in to INTIME. You should also know the amount due.

State tax due from line J of worksheet _____State Tax. Ad 100s of Top Rated Local Professionals Waiting to Help You Today. Indiana Department of Revenue Estimated Tax Payment Form Estimated Tax Designation and Payment Area Complete the worksheet on the back of this form to figure your estimated tax payment.

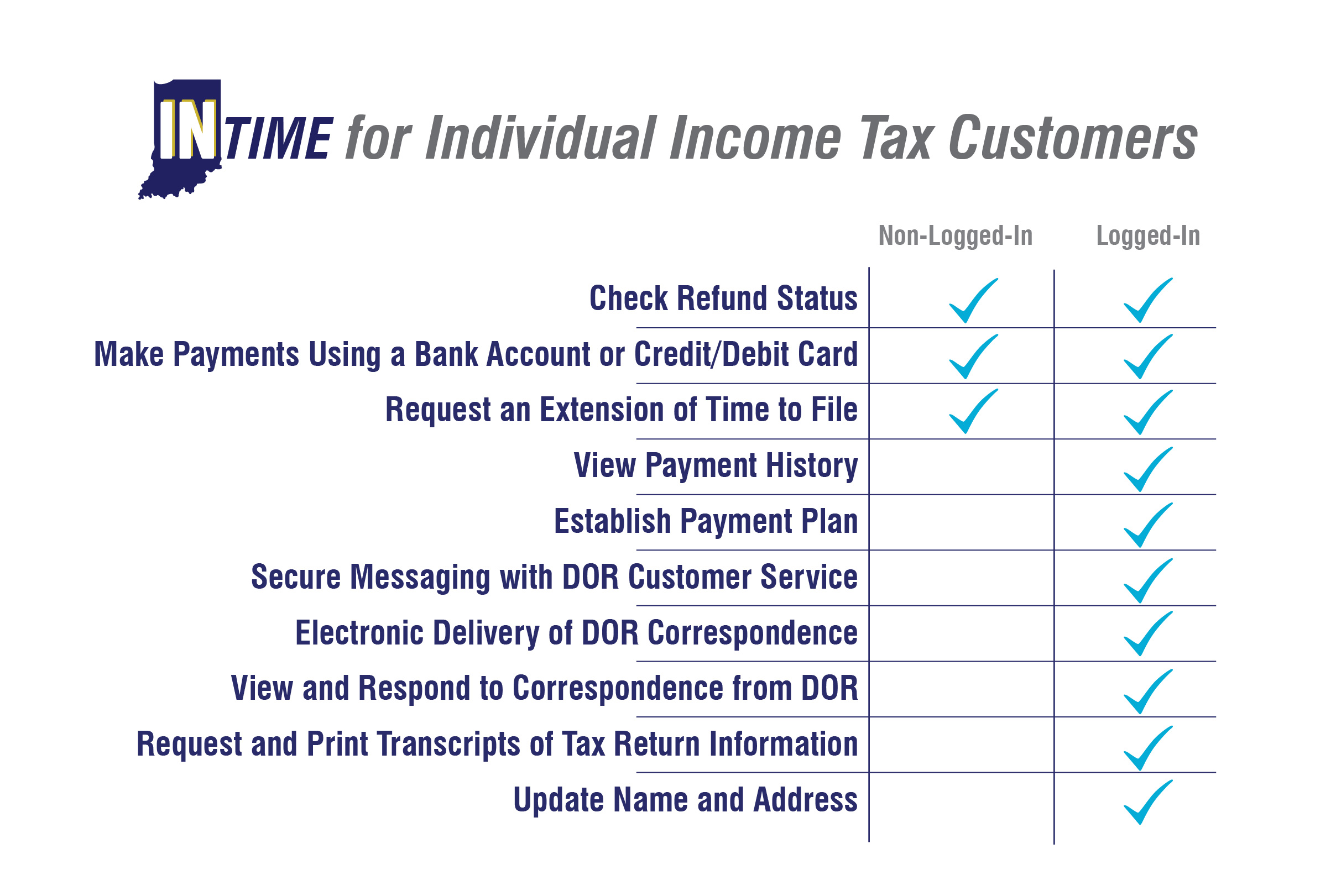

Have more time to file my taxes and I think I will owe the Department. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247.

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. Indiana Department of Revenue - DORpay.

Kansas City MO 64108. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. On your Federal income tax return or pay income tax on them.

FreeTaxUSA FREE Tax Filing Online Return Preparation E-file Income Taxes. The IRS charges 05 of the unpaid taxes for each month with a cap of 25 of the unpaid taxes. To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer Information Management Engine INTIME at intimedoringov.

Access INTIME at intimedoringov. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. Visit our website at wwwingovdor4340 and follow the prompts for making an estimated tax payment.

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. Know when I will receive my tax refund. Claim a gambling loss on my Indiana return.

Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and. Take someone who pays. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service.

Estimated income tax payments are made to pay taxes on income generated in a given tax year - now 2021 - that is not subject to periodic tax withholding payments as wages are via the W-4 formGenerally if you are an employee whose only income is from a W-2 with taxes withheld you will not have to worry about making estimated income tax payments as this is done through. Indiana Michigan Minnesota Missouri Montana Nebraska New Jersey Ohio West Virginia. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check.

Follow the links to select Payment type. Federal 0 State 1499. If you are filing as a sole proprietor a partner an S corporation shareholder andor a self-employed individual and expect to owe taxes of 1000 or more when you file a return you should use Form 1040-ES Estimated Tax for Individuals to calculate and pay your estimated tax.

Rates do increase however based on geography. If you expect to have income during the tax year that. Whether youre a large multinational.

Income tax or estimated tax paid. Find Indiana tax forms. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247.

Estimated payments may also be made online through Indianas INTIME website. You may pay estimated taxes either. Have more time to file my taxes and I think I will owe the Department.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Select the Make a Payment link under the Payments tile. If you work in or have business income from Indiana youll likely need to file a tax return with us.

Do it for free. Take the renters deduction. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

- scrolls down to website information. Take the renters deduction. They will not affect your income for purposes of.

When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. INTAX only remains available to file and pay special tax obligations until July 8 2022. Pay my tax bill in installments.

E-file directly to the IRS. Know when I will receive my tax refund. How to Pay Estimated Taxes.

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. View the amount you owe your payment plan details payment history and any scheduled or pending payments. County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1.

INtax only remains available to file and pay the following tax obligations until July 8 2022.

Indiana Sales Tax Small Business Guide Truic

Indiana Paycheck Calculator Smartasset

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

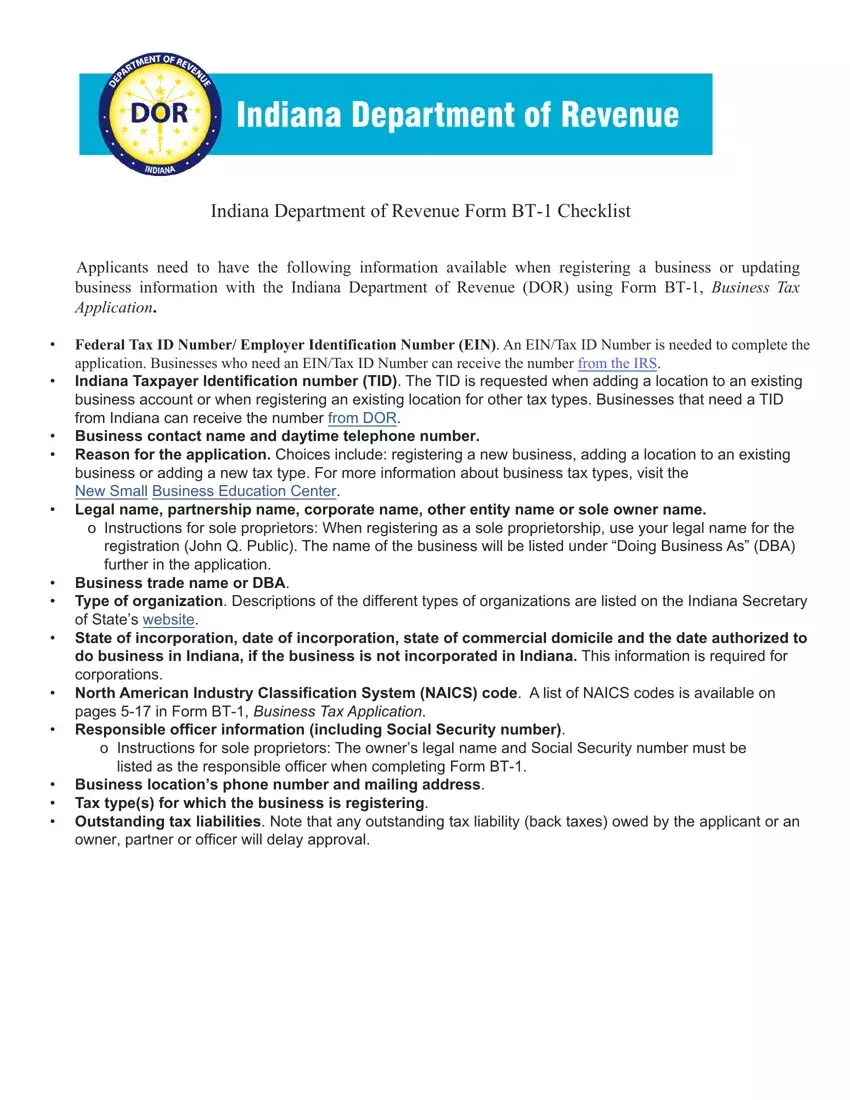

Form Bt 1 Indiana Fill Out Printable Pdf Forms Online

Dor Keep An Eye Out For Estimated Tax Payments

Indiana State Tax Information Support

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic